Trade Overview

Trade in Spiral Steel Pipes between China and Saudi Arabia has shown steady growth in recent years. As the world's largest steel pipe producer, China exports significant

quantities of oil and gas pipelines, structural pipes, and other related products to Saudi Arabia. Meanwhile, Saudi Arabia, as the largest energy producer in the Middle East,

maintains strong and continuous demand for pipe construction.

China's Export Advantages

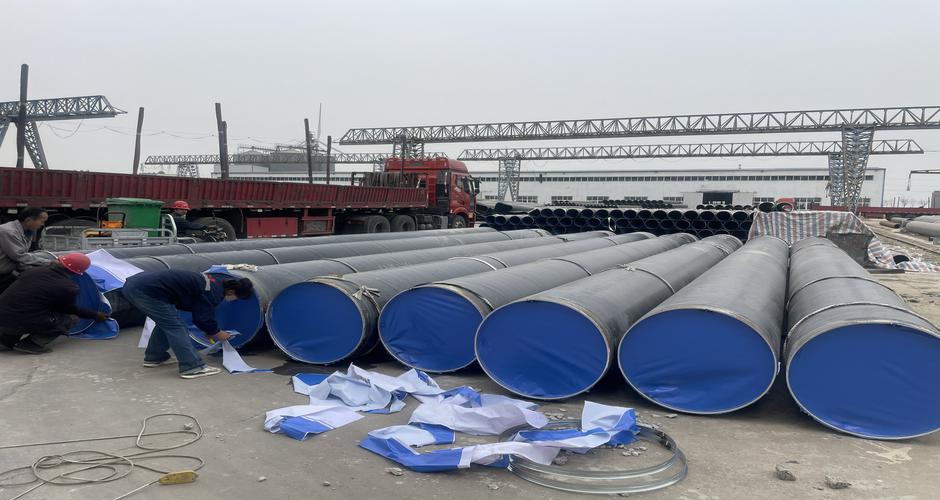

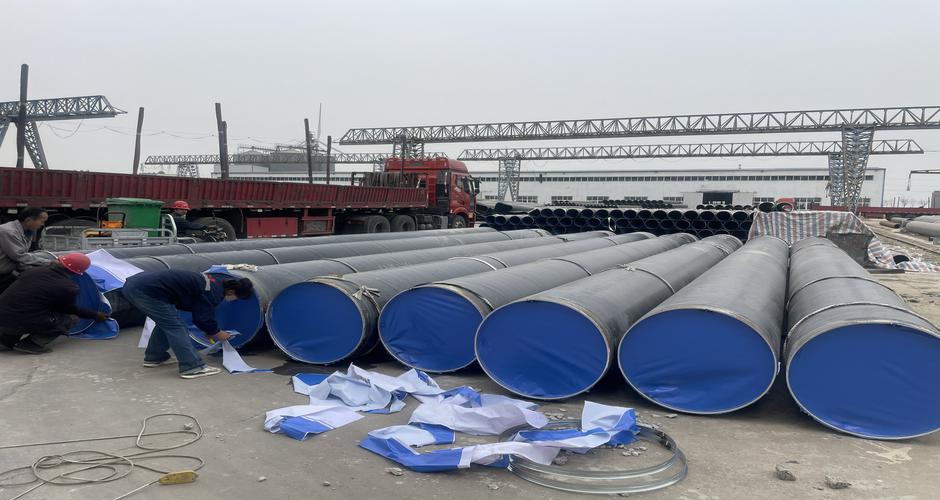

Production Capacity and Technological Edge:

China possesses the world's most complete spiral welded pipe industrial chain

Mature double-submerged arc welding technology with products meeting international standards

Cost advantages from large-scale production

Price Competitiveness:

Chinese products are 20-30% cheaper than comparable European and American products

Complete supply chain from raw materials to finished goods

Product Adaptability:

Customizable specifications to meet Saudi oil and gas project requirements

Strong R&D capabilities for specialized pipes suited to high-temperature desert environments

Saudi Market Demand

Major Application Areas:

Oil and gas transmission pipelines (65% of demand)

Urban water supply and drainage systems (20%)

Construction structural pipes (15%)

Demand Drivers:

Mega infrastructure projects under Saudi Vision 2030

Oil and gas field development and pipeline network expansion

Pipeline needs for large-scale projects like NEOM City

Demand from desalination project pipelines

Trade Data Performance

Export Volume:

In 2022, China exported 850,000 tons of steel pipes to Saudi Arabia

Spiral welded pipes accounted for 40% of total exports

Annual growth rate maintained at 8-12%

Price Range:

Standard specifications: 800−1,200 per ton

Special specifications: 1,500−2,000 per ton

Competitive Landscape

Major Chinese Suppliers:

Tianjin Pipe Group

Baosteel

Hunan Sunrise Steel Group

Valin Steel

Zhujiang Steel Pipe

Local Saudi Competitors:

Saudi Steel Pipe Company

ArcelorMittal Jubail

Local production meets only 30% of domestic demand

Trade Barriers and Challenges

Technical Barriers:

Saudi Arabia is gradually raising requirements for international certifications like API

Some projects mandate European/American standards

Trade Policies:

Need to monitor anti-dumping risks

Increasing local content requirements

Logistical Challenges:

Volatility in shipping costs

Strict delivery timeline requirements

Development Recommendations

For Chinese Exporters:

Strengthen international certifications (API, ISO, etc.)

Establish local warehouses or service centers in Saudi Arabia

Build strategic partnerships with Saudi EPC contractors

For Saudi Buyers:

Develop long-term supplier evaluation mechanisms

Consider direct partnerships with Chinese mills to reduce costs

Monitor new Chinese technologies for specialized sprial welded steel pipes

Future Outlook

With Saudi Arabia's energy transition and economic diversification, China's welded steel pipe exports to Saudi Arabia are expected to maintain an annual growth rate of 10%

through 2025. Pipes for renewable energy applications, along with high-temperature/high-pressure resistant specialty pipes, will emerge as new growth drivers. Chinese

manufacturers should capitalize on opportunities in high-end pipe demand arising from Saudi Arabia's industrialization process.